The Corona virus (COVID-19) has already caused the death of more than three thousand people in China (1) and almost 4000 people in other countries. In Brazil, three hundred and one cases of the disease were confirmed and more than 2000 suspected cases(2).

In addition to the enormous and regrettable human losses, the increase in cases outside China has caused a major retraction in major capital markets around the world. The fear of a pandemic and consequent retraction of global economic activity has generated panic in the world's main stock exchanges and throughout the production chain in general.

In an increasingly globalized world with interconnected production processes, a crisis of this magnitude in one of the world's largest production parks affects practically all industrialized countries.

In the mining sector, the situation is no different. With China as the main consumer market for a large part of mineral commodities, mining companies fear that the drop in Chinese economic activity will culminate in a retraction in demand for mineral inputs.

In part, this has already been happening, in parallel with the release of data on the contraction of Chinese industrial activity in February, reaching levels close to those observed in 2004(3), Brazilian iron ore exports also fell by 23.6% in February compared to the same period in 2019(4).

In addition to the impacts on the consumer market of its products, the Brazilian mineral industry also suffers from the importation of equipment and parts. With the advance of the disease in China, several factories have interrupted their operations, drastically reducing the manufacture and availability of machines for the most diverse sectors.

Despite the negative outlook for the industry in the world, analysts believe that the real impacts on the world economy can be mitigated with the end of winter in the northern hemisphere and progress in research into vaccines and drugs against the disease.

In any case, the Brazilian mineral industry, which was still recovering from the international commodity crises and the political-economic crisis experienced in the second half of this decade, will have great challenges this year with the reduction in demand and price of its main mineral goods.

Impact on the price of Iron Ore

The sharp drop in Chinese demand for Iron Ore had a direct impact on January and February 2020 contracts for the sale of Brazilian ore. The Platts index, the main reference index for the purchase and sale of iron ore, fell from 95.65 USD/t at the beginning of the year to 82.55 USD/t at the end of January after the spread of the disease in China was announced. The index has now recovered slightly , reaching 87.85 USD/t (5) .

The drop in prices that occurred during the period, however, is much smaller than that observed during the commodity crises in 2016 and 2017 , when iron ore was traded at USD 37.00/t.

As a direct impact of this drop in prices and the forecasts of the spread of COVID-19 around the world, Vale's shares have already fallen 11.4%, while Gerdau has lost 9.2% (6) . Despite this, analysts believe that prices may recover in 2020 with the consumption of the stock of ore accumulated in Chinese ports due to the slowdown in production activities, and due to the Chinese government's actions to stimulate the economy.

Impact on other mineral commodities

As with Iron Ore, several other mineral commodities saw sharp price drops after the release of data on the spread of the Coronavirus in China. According to an official statement from BHP Billiton, the world's largest mining company, “If the viral outbreak is not demonstrably contained in the first quarter, we expect to revise our expectations for economic and commodity demand growth downwards.”

This trend is reflected in the price of the main mineral commodities, such as Copper, which reached its peak in the year at 6,300.50 USD/t and is currently traded at 5,669.76 USD/t (7) .

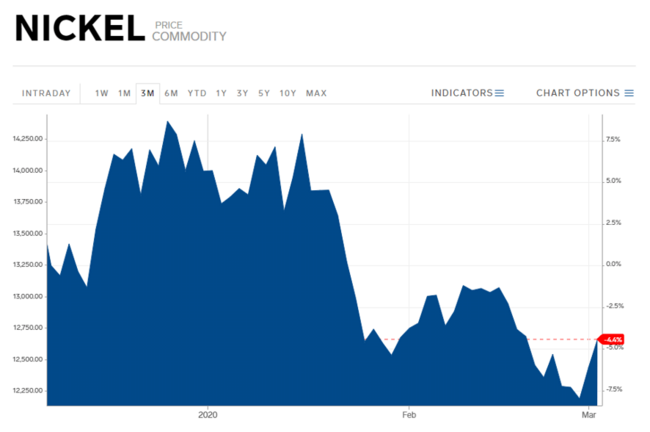

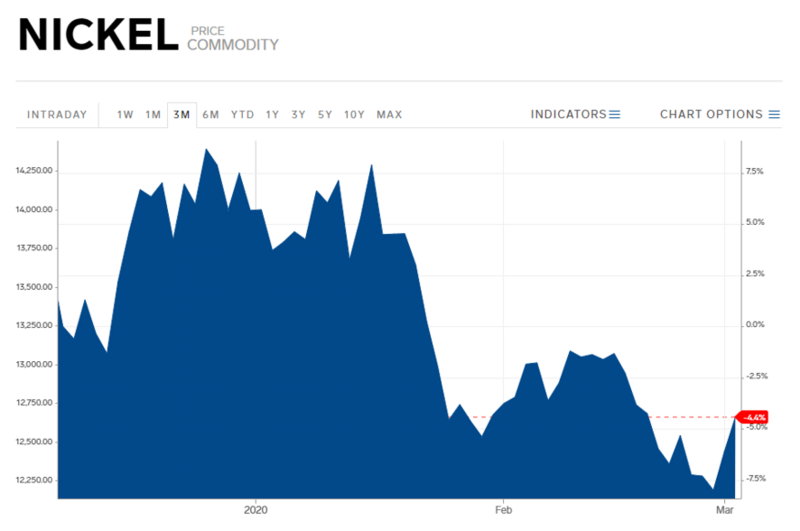

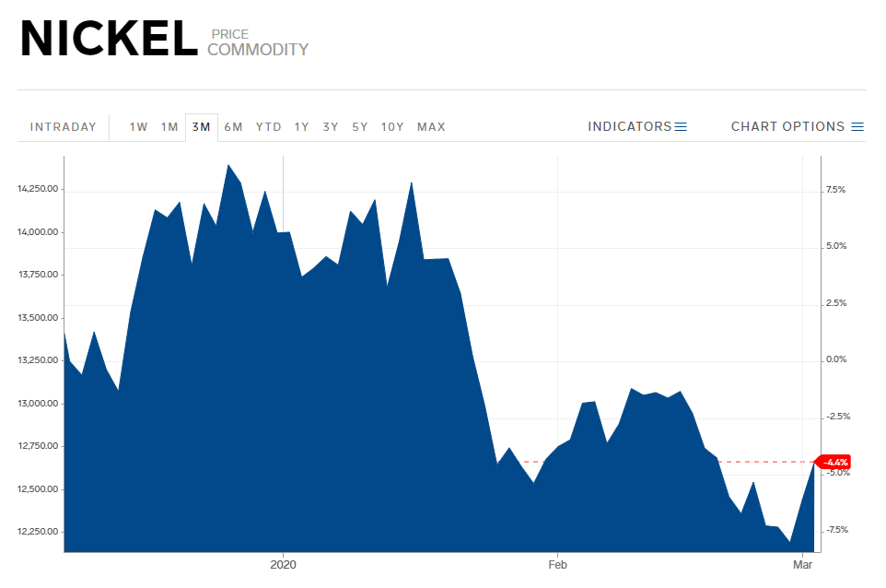

Similarly, Nickel suffered a sharp decline from the second half of January, when alarming data on the increase in confirmed cases of Coronavirus were released. The commodity was traded at 14,290.00 USD/t in January and is currently quoted at 12,659.10 USD/t (8) .

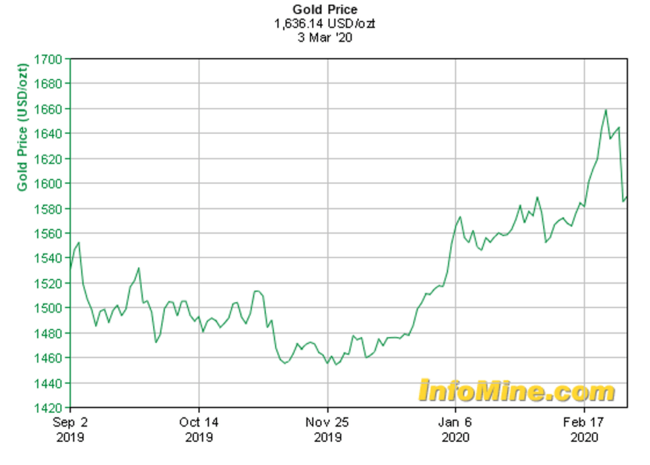

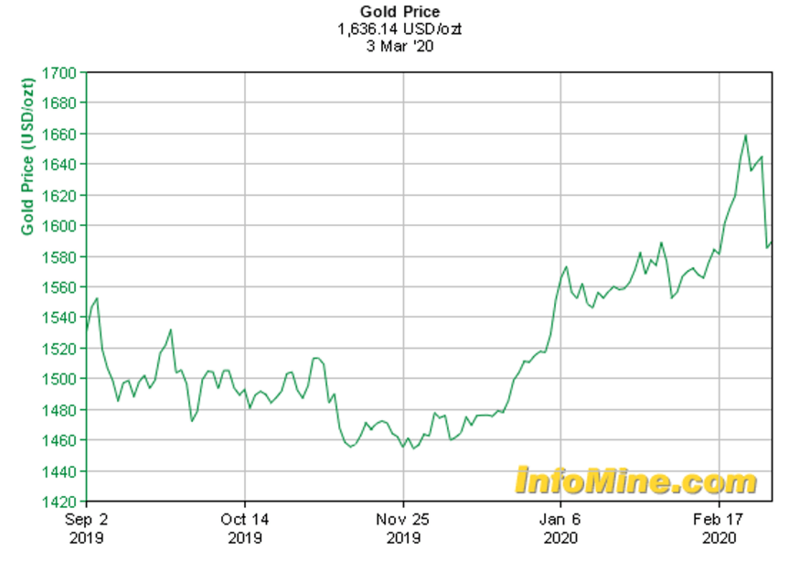

Contrary to most metals, Gold has shown a notable increase in its price mainly due to the chaos created in the financial markets by the spread of COVID-19. The yellow metal is seen as a safe haven for investors in times of crisis , therefore it went from 1460.00 USD/oz at the end of last year to 1660.00 USD/oz in January of this year (9) .

What to expect for 2020

In a highly speculative and volatile environment, forecasts for the year have been dismantled with each new piece of news about the spread of the virus. Despite this, analysts believe that the end of winter in the northern hemisphere and global efforts in research into COVID-19 may bring a more peaceful environment in the second half of 2020.

Credit Suisse, for example, highlighted that iron ore had the worst time with the Chinese virus . “Iron ore was priced for robust demand and reduced supply in the first quarter, but the virus has led to the opposite, with demand absent and port inventories likely to increase” (10) .

It is unclear how quickly the global economy will recover, even if the spread of the virus subsides. However, the recent decline in the daily increase in confirmed cases of the disease may indicate that industrial activity in China will recover in 2020, and consequently, bring mineral commodity prices back to the levels seen at the end of 2019.

Furthermore, the Chinese government has taken measures to revive its productive activity, such as reducing corporate taxes and cutting government spending, which should have an effect in the second quarter.

Other global economic powers have announced measures to mitigate the effects of the Coronavirus on the global economy , such as the United States, which, through the FED, announced a 0.5 percentage point cut in its basic interest rate. The same happened in Australia and should happen in Brazil at the next Copom meeting (11) .

The European Union is also preparing measures to stimulate the economy , such as tax exemptions and installment payments of tax debts. Such measures give companies more breathing room to honor their commitments, in addition to providing cheaper credit, favoring investment in the most diverse productive sectors.

While government actions are aimed at stimulating the global economy so that the effects of the Coronavirus can dissipate quickly, they also demonstrate the great concern of countries regarding the impact of the virus’s spread on their economies. The coming weeks will show more clearly the real impact of these actions on the global economy, and consequently on the mining sector.

- According to monitoring by Johns Hopkins University

- According to data from the Ministry of Health, March 17, 2020;

- According to the National Bureau of Statistics (BNS), as reported by France Press. The purchasing managers' index (PMI) for the month of February stood at 35.7 points, against 50.0 in January, according to the BNS. A figure above 50 indicates expansion of activity and below, contraction;

- According to data from the Foreign Trade Secretariat (Secex), released on 03/02/2020;

- Iron Ore Index – IODEX – PLATTS – 03/03/2020;

- Comparing January 20 to March 3, 2020;

- Source: https://markets.businessinsider.com/ ;

- Source: https://markets.businessinsider.com/ ;

- Source: https://infomine.com

- Via Infomoney

- COPOM meeting on March 17 and 18, 2020.