The Annual Mining Report (RAL), imposed by the current legislation, in Art.67 of the ANM Normative Consolidation attached to Ordinance No. 155 of May 12, 2016, is the document in which the information of the activities developed by the miner in the previous year is declared, such as mining, processing, updating of resources and reserves, consumer market, labor, among others.

Through this report, it is possible to gather important information about the mineral sector, which is later used to prepare the Brazilian Mineral Yearbook (ANB). In the yearbook, relevant data on the performance and development of mining in the country are presented.

Throughout this text, we will address the deadlines for submitting the RAL, what must be included in the document, how to deliver it and the consequences of not sending it or having a delay in delivery. Keep reading and learn more!

Deadlines for submission

The declaration of the RAL is mandatory and must be made by all holders or lessees of mining titles and user guides, regardless of the operational situation of the mine (in operation or not). The submission deadlines are as follows:

- Until March 15 of each year: mine manifest, mining decree, mining ordinance, mining group, mining consortium, license registration with economic development plan approved by the ANM, mining permit, extraction registration and titled areas with a use guide.

- Until March 31 of each year: miners who have licensing titles without the Economic Exploitation Plan (PAE).

What should be included in the RAL?

According to the Mining Code – Chapter III of Mining Art.50, the report must contain:

- Method of mining, transportation and distribution in the consumer market of the extracted mineral substances;

- changes in the reserves, characteristics of the mineral substances produced, including the minimum economically compensating content and the relationship observed between the useful and the waste substance;

- Monthly table, which includes, at least, the elements of: production, inventory, average sale price, destination of the gross product and the beneficiary, payment of the Single Tax and the payment of the owner's Tithe;

- Number of mine and processing workers;

- Investments made in the mine and in research work;

- Annual balance sheet of the Company.

Delivery

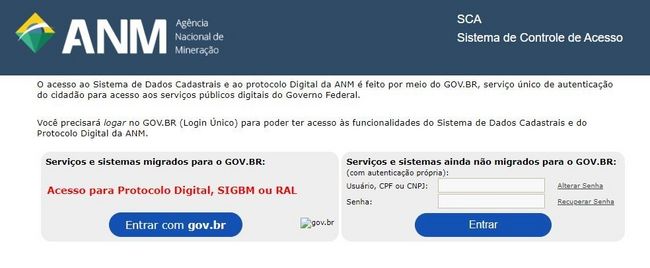

The submission of the RAL must be done through the RAL Web system. Access is via the federal government's single login. It is mandatory that all holders and technical responsible persons have prior registration in the SDC (Registration Data System) of the ANM. It is up to the declarant to indicate, in the specific field of the RAL Web, all mining processes.

What are the consequences of not declaring the RAL?

Failure to submit the RAL or its submission after the deadline, as well as the provision of false statements or omission of information by the declarant, constitutes a violation of mineral legislation. In this situation, the miner is subject to the applicable sanctions, including the application of a fine for each mining process of which they are holders or lessees. The amount of the fine can reach up to R$3,705.19 per mining title.

Did you like this text? Visit our blog for more content like this.

References:

https://www.gov.br/anm/pt-br/assuntos/acesso-a-sistemas/relatorio-anual-de-lavra-ral-1

https://www.dnpm-pe.gov.br/Legisla/CN_DNPM.htm

https://www.minasjr.com.br/anuario-mineral-relatorio-anual-de-lavra-ral/

https://app.anm.gov.br/RAL/default.html

https://blog.jazida.com/relatorio-anual-de-lavra-ral-2020/

https://www.geotechconsultoria.com/ral-relatorio-anual-de-lavra-o-que-e/