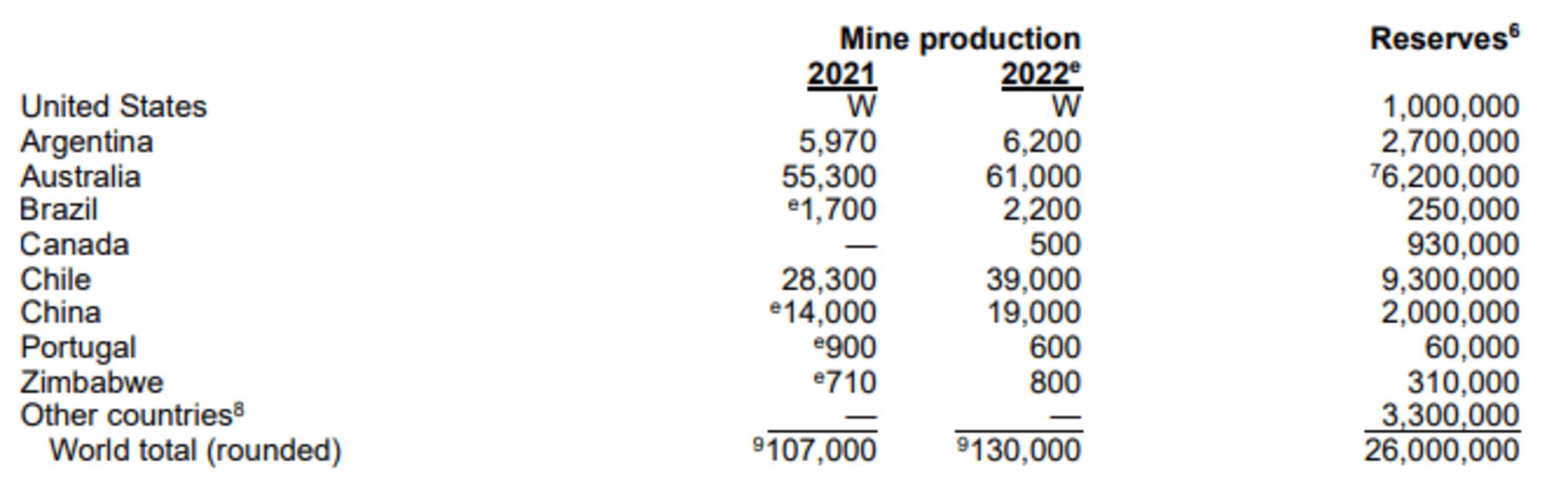

Lithium has been the subject of a global race in recent years between countries such as Chile, Argentina, Australia and China, which have led the way in producing the mineral. This is leading to a growing demand in the manufacture of lithium-ion batteries that power electronic devices, electric cars and renewable energy storage systems.

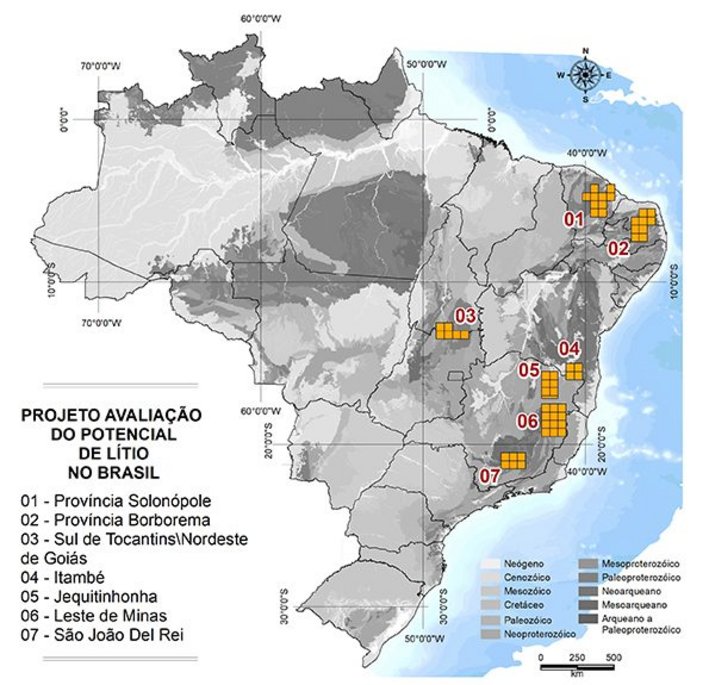

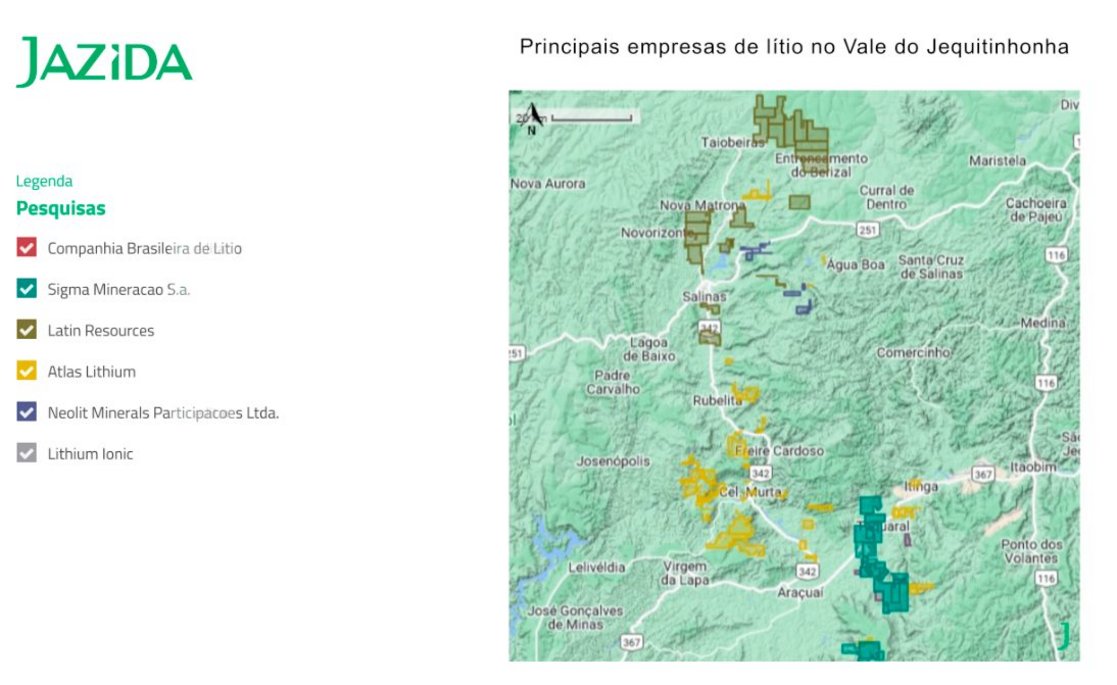

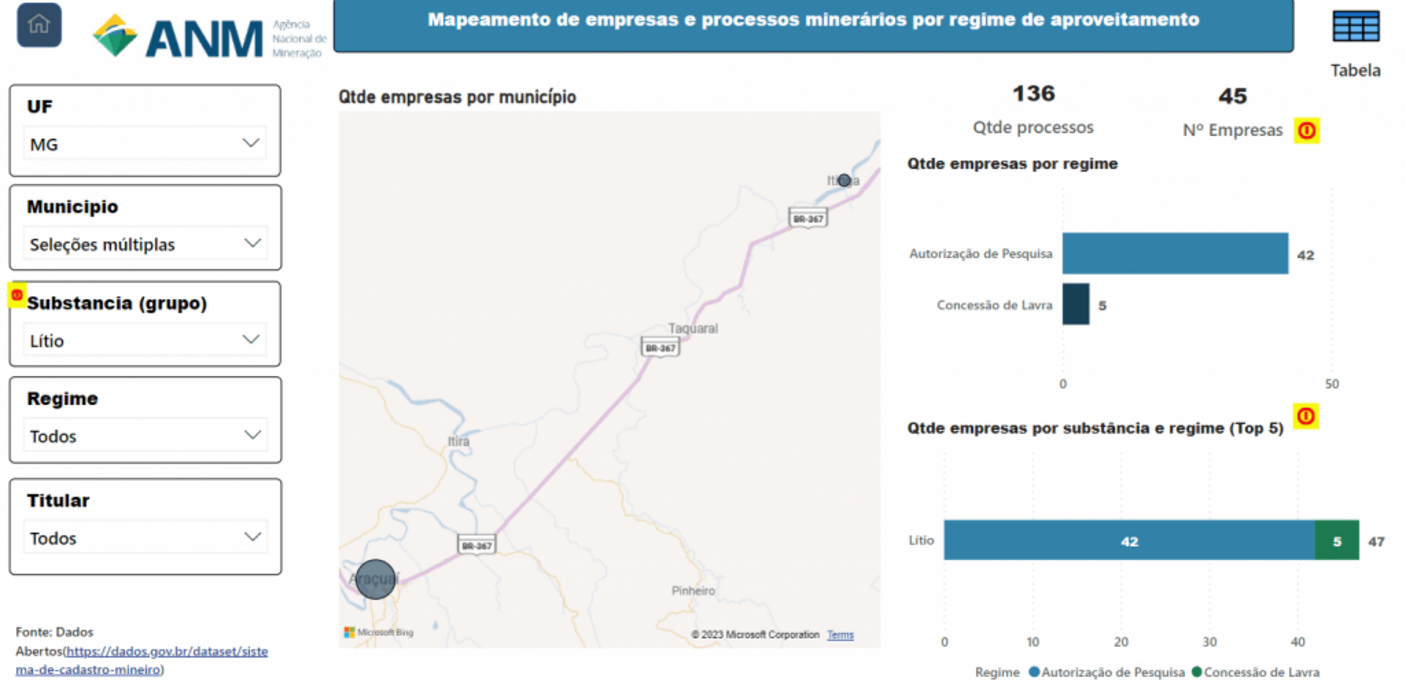

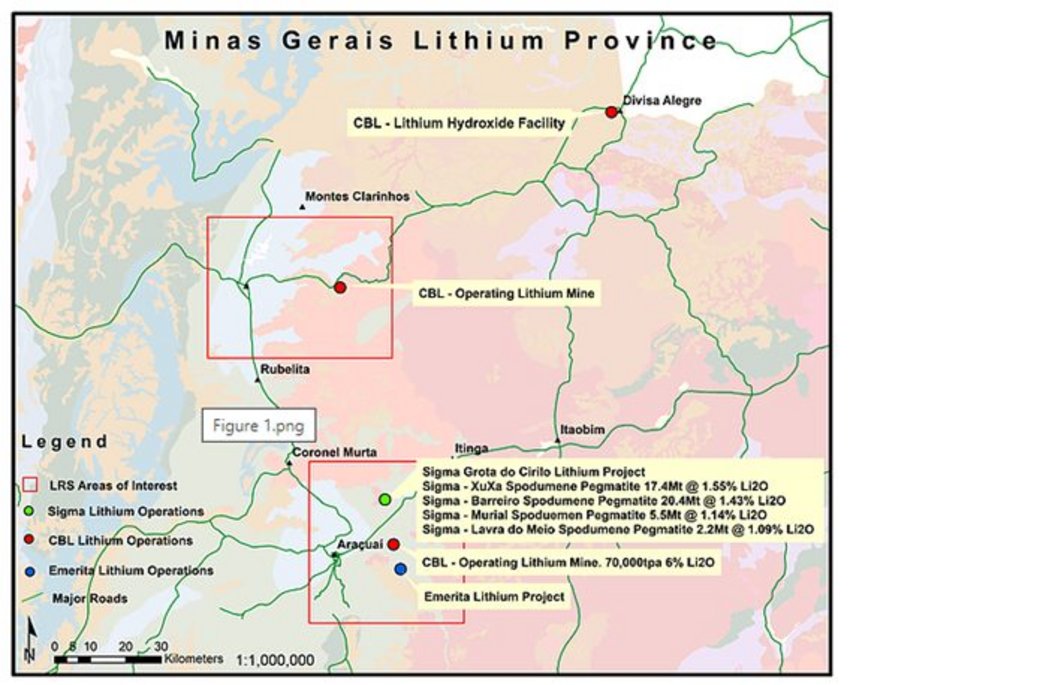

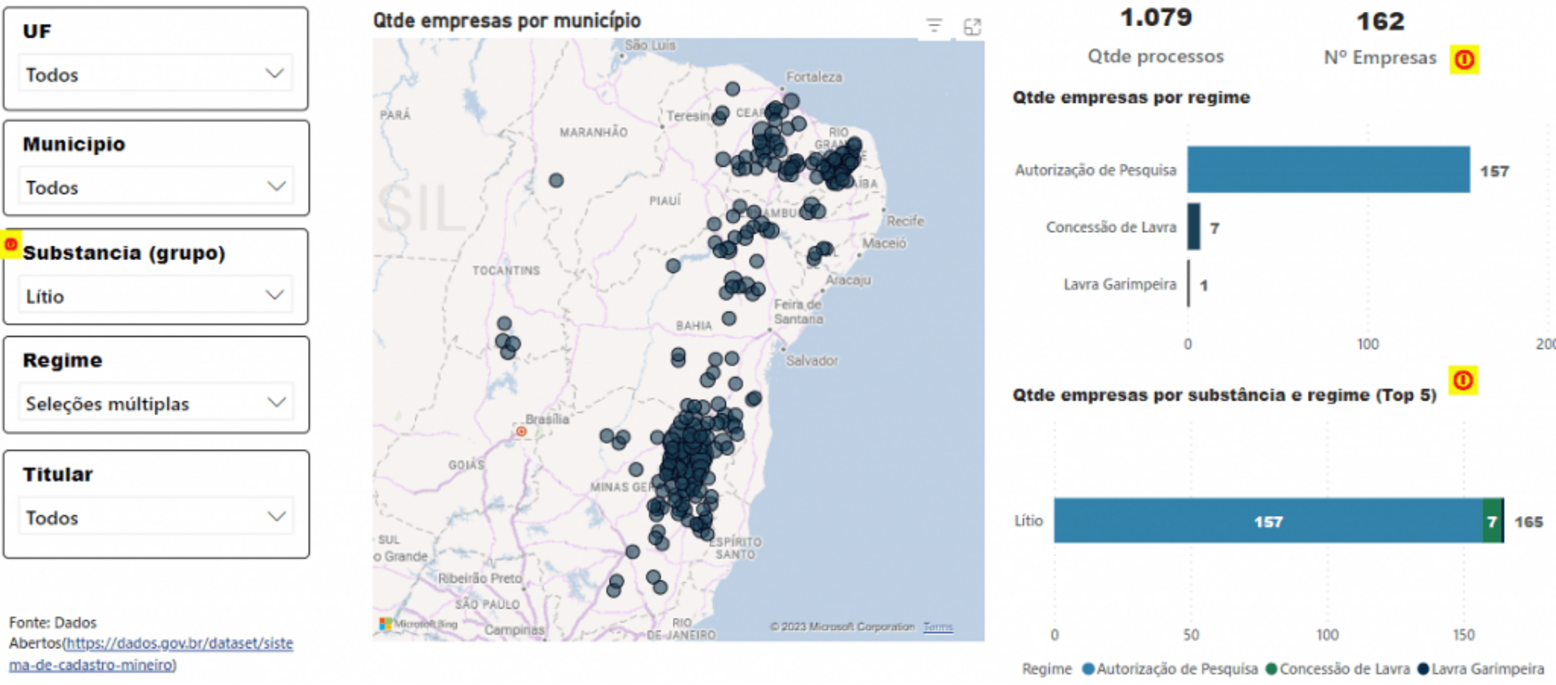

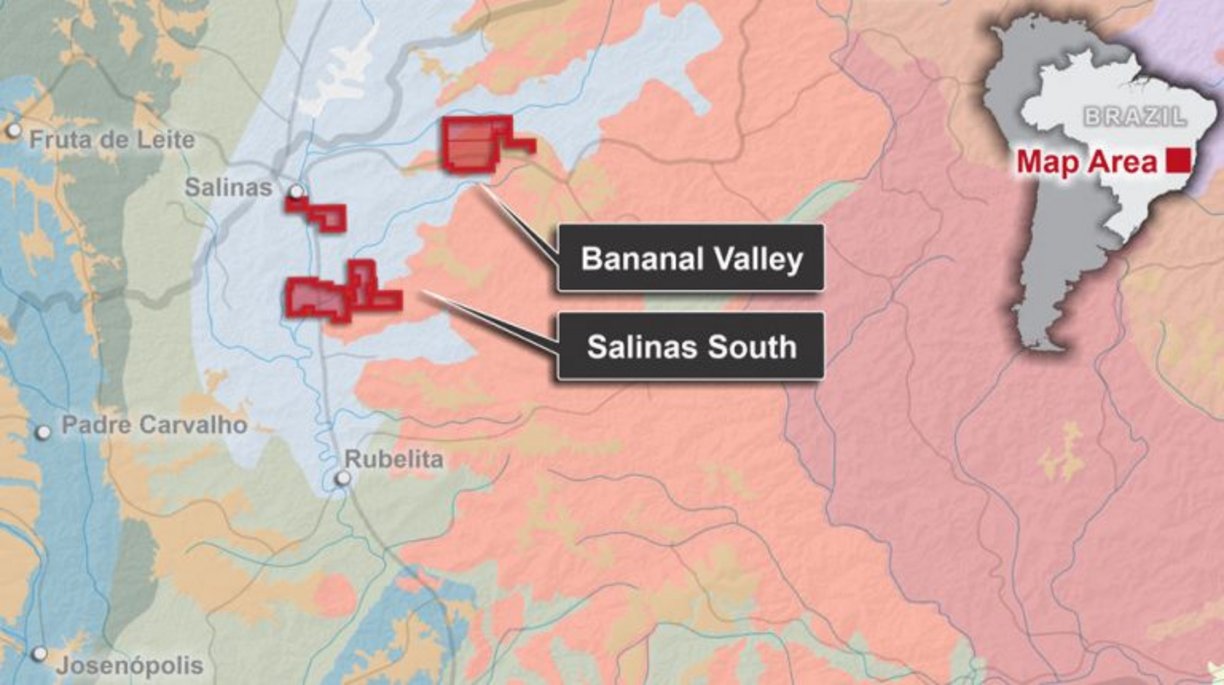

Brazil has great potential for lithium exploration, especially in the Jequitinhonha Valley in Minas Gerais, where the country's largest reserves are located. Last week, the Brazilian Mining Institute (IBRAM), the government of Minas Gerais and the Ministry of Mines and Energy (MME) organised the "Vale do Lítio" initiative to attract international investment in the creation of a lithium exploration and industrialisation hub in the region. The region has attracted the interest of two mining companies listed on Nasdaq (National Association of Securities Dealers Automated Quotations), the world's second largest stock exchange. These mining companies are Sigma Lithium (NASDAQ: SGML) and Atlas Lithium (NASDAQ: ATLX). Other companies are also developing projects in the region, such as Lithium Ionic (TSX: LTH), listed on the Toronto stock exchange, and Latin Resources (ASX: LRS), listed on the Australian stock exchange, and the Brazilian Lithium Company (CBL). The aim is to turn the region into one of the world's leading lithium producers.